Getting My Affordable Bankruptcy Lawyer Tulsa To Work

Getting My Affordable Bankruptcy Lawyer Tulsa To Work

Blog Article

6 Simple Techniques For Which Type Of Bankruptcy Should You File

Table of ContentsSome Known Factual Statements About Tulsa Ok Bankruptcy Attorney The Facts About Bankruptcy Lawyer Tulsa RevealedThe Basic Principles Of Top Tulsa Bankruptcy Lawyers The Definitive Guide to Top Tulsa Bankruptcy LawyersAn Unbiased View of Top Tulsa Bankruptcy LawyersThe Buzz on Tulsa Ok Bankruptcy Attorney

Individuals must make use of Chapter 11 when their financial obligations surpass Phase 13 financial debt limitations. Tulsa bankruptcy attorney. Phase 12 personal bankruptcy is developed for farmers and anglers. Phase 12 settlement plans can be a lot more versatile in Phase 13.The means examination takes a look at your ordinary monthly earnings for the six months preceding your filing date and contrasts it against the typical revenue for a comparable household in your state. If your revenue is below the state average, you immediately pass and do not have to finish the whole kind.

If you are married, you can submit for bankruptcy jointly with your spouse or separately.

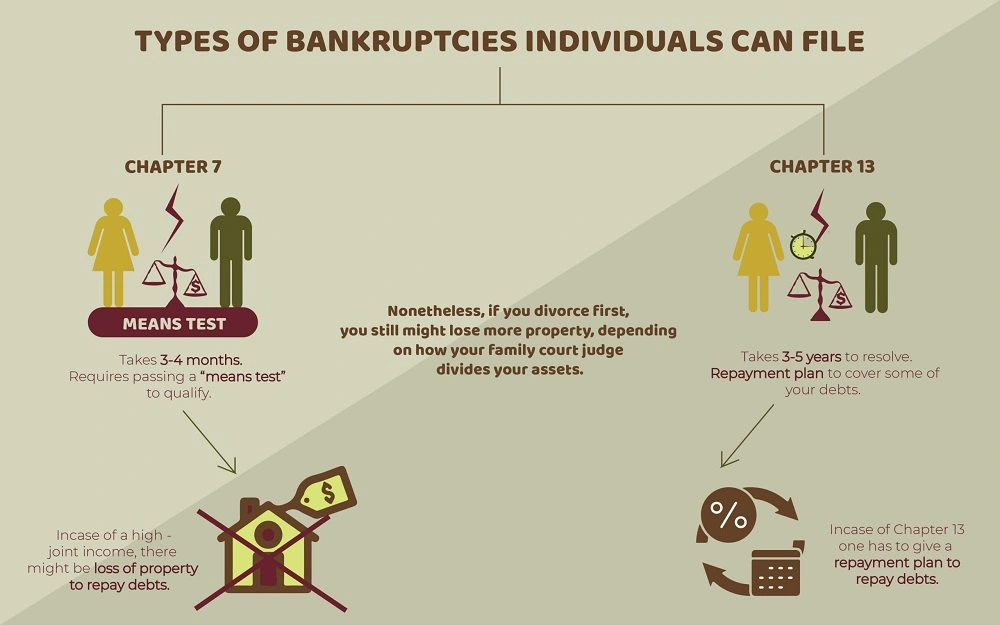

Filing bankruptcy can help an individual by discarding financial obligation or making a strategy to pay off financial debts. An insolvency case generally begins when the debtor submits an application with the bankruptcy court. There are various kinds of personal bankruptcies, which are normally referred to by their phase in the United state Insolvency Code.

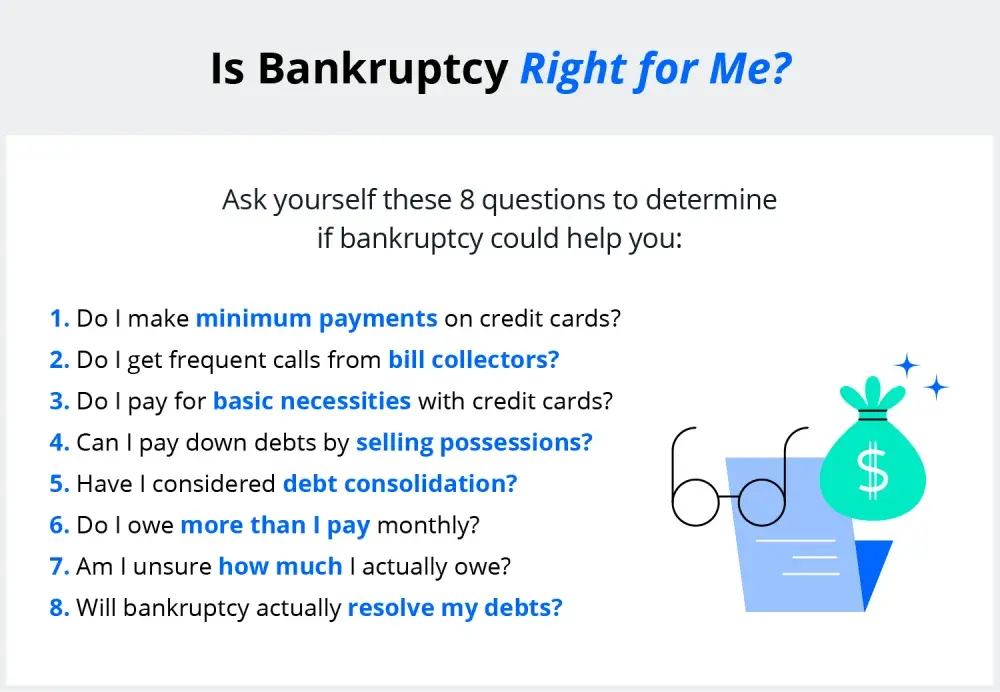

If you are facing economic challenges in your personal life or in your organization, opportunities are the principle of filing personal bankruptcy has actually crossed your mind. If it has, it likewise makes sense that you have a great deal of personal bankruptcy concerns that require responses. Many individuals actually can not respond to the concern "what is personal bankruptcy" in anything other than general terms.

If you are facing economic challenges in your personal life or in your organization, opportunities are the principle of filing personal bankruptcy has actually crossed your mind. If it has, it likewise makes sense that you have a great deal of personal bankruptcy concerns that require responses. Many individuals actually can not respond to the concern "what is personal bankruptcy" in anything other than general terms.Numerous people do not recognize that there are numerous kinds of insolvency, such as Chapter 7, Chapter 11 and Chapter 13. Each has its benefits and obstacles, so knowing which is the very best option for your present circumstance as well as your future healing can make all the difference in your life.

9 Easy Facts About Which Type Of Bankruptcy Should You File Shown

Phase 7 is described the liquidation bankruptcy phase. In a chapter 7 bankruptcy you can eliminate, eliminate or release most kinds of debt. Examples of unprotected financial obligation that can be wiped out are debt cards and medical bills. All kinds of people and business-- individuals, married pairs, companies and partnerships can all file a Phase 7 insolvency if eligible.

Lots of Chapter 7 filers do not have a great site lot in the way of assets. Others have residences that do not have much equity or are in significant need of repair service.

The quantity paid and the duration of the plan relies on the debtor's home, typical revenue and costs. Financial institutions are not enabled to go after or preserve any collection tasks or suits during the situation. If effective, these creditors will certainly be erased or discharged. A Phase 13 bankruptcy is really powerful because it gives a device for borrowers to avoid foreclosures and sheriff sales and quit repossessions and utility shutoffs while capturing up on their safeguarded debt.

The 10-Minute Rule for Bankruptcy Lawyer Tulsa

A Chapter 13 case might be advantageous in that the debtor is enabled to get caught up on mortgages or vehicle loan without the danger of repossession or repossession and is enabled to keep both exempt and nonexempt residential or commercial property. The debtor's strategy is a record laying out to the personal bankruptcy court how the borrower proposes to pay existing costs while paying off all the old financial debt equilibriums.

It gives the debtor the opportunity to either offer the home or become captured up on mortgage settlements that have fallen back. A person submitting a Chapter 13 can recommend a 60-month plan to heal or end up being current on home loan settlements. For example, if you fell back on $60,000 worth of home mortgage settlements, you might suggest a strategy of $1,000 a month for 60 months to bring those home loan payments present.

It gives the debtor the opportunity to either offer the home or become captured up on mortgage settlements that have fallen back. A person submitting a Chapter 13 can recommend a 60-month plan to heal or end up being current on home loan settlements. For example, if you fell back on $60,000 worth of home mortgage settlements, you might suggest a strategy of $1,000 a month for 60 months to bring those home loan payments present.The Ultimate Guide To Tulsa Ok Bankruptcy Specialist

Occasionally it is much better to prevent insolvency and resolve with financial institutions out of court. New Jacket also has an alternative to bankruptcy for companies called an Task for the Advantage of Creditors and our regulation firm will certainly look at this alternative if it fits as a potential approach for your business.

We have created a device that aids you choose what chapter your file is more than likely to be filed under. Click on this link to use ScuraSmart and learn a feasible remedy for your debt. Lots of people do not understand that there are several kinds of bankruptcy, such as Phase 7, Chapter 11 and Phase 13.

Below at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we handle all kinds of bankruptcy cases, so we have the ability to answer your insolvency inquiries and aid you make the finest decision for your instance. Below is a brief consider the financial debt alleviation alternatives available:.

Not known Factual Statements About Top-rated Bankruptcy Attorney Tulsa Ok

You can only submit for personal site web bankruptcy Prior to declaring for Phase 7, at least one of these ought to be real: You have a lot of financial obligation revenue and/or assets a creditor can take. You have a lot of financial debt close to the homestead exemption amount of in your home.

The homestead exception amount is the greater of (a) $125,000; or (b) the region mean sale price of a single-family home in the coming before fiscal year. is the quantity of cash you would certainly keep after you sold your home and paid off the home mortgage and various other liens. You can discover the.

Report this page